2024’s Game-Changer: The Inside Story of Bitcoin Revolutionizing Property Financing

#Bitcoin #RealEstate #BTC

What if the world’s oldest investment—real estate—collided with the world’s most disruptive asset—Bitcoin?

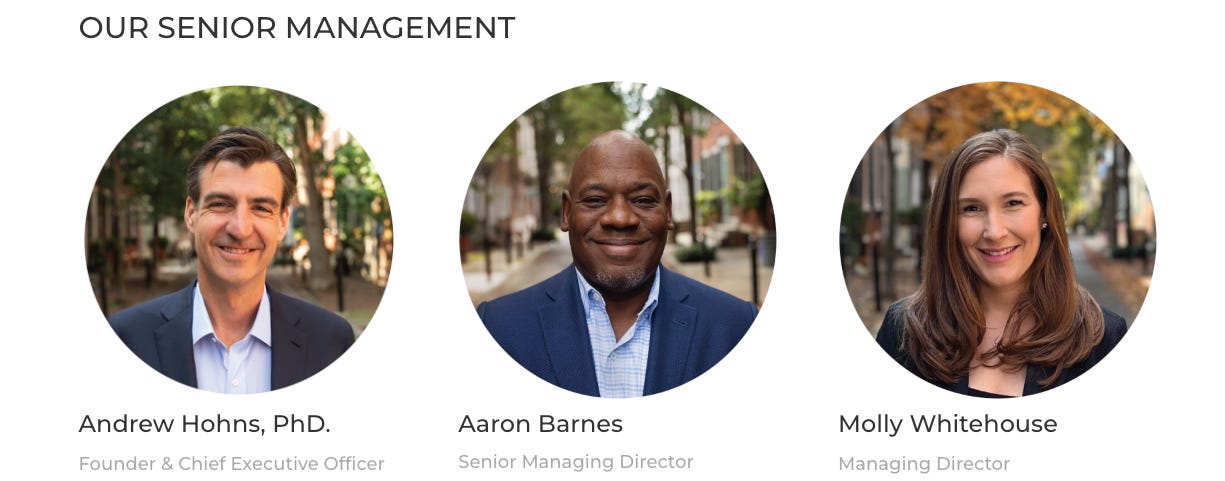

In 2024, Newmarket Capital made this bold leap, redefining commercial real estate financing forever.

Here’s the inside story of how Bitcoin became collateral. 🧵👇

For decades, commercial real estate financing was ruled by banks.

The process? Slow, expensive, and frustrating.

📝 Endless paperwork.

💸 Onerous down payments.

⏳ Deals lost to bureaucratic delays.

Then Bitcoin entered the chat.

But how does Bitcoin fit into real estate?

In one word: collateral.

Newmarket Capital saw an opportunity no one else dared to explore.

What if Bitcoin—a 24/7, borderless, provable asset—could back loans for commercial real estate deals?

The idea was revolutionary.

🔑 No need for traditional property-based collateral.

🔒 Smart contracts ensure transparency.

⚡ Deals close in days, not months.

Newmarket’s pitch? They could unlock liquidity for Bitcoin holders AND disrupt the $11T real estate market.

The pain points were obvious

Traditional banks demand:

❌ 20-30% equity upfront.

❌ Months of due diligence.

❌ Little flexibility for creative financing.

Meanwhile, billions in Bitcoin just sat idle in wallets. Untapped potential.

Here’s where Newmarket Capital broke the mold.

They offered a simple yet powerful solution:

🏦 Borrowers could pledge Bitcoin as collateral.

🏢 Lenders could fund real estate purchases with security.

No middlemen. No delays. Just blockchain-backed efficiency.

The world took notice.

Skeptics said it couldn’t work.

🔸 “Bitcoin’s too volatile!”

🔸 “Banks won’t accept this.”

🔸 “Regulators will shut it down!”

But Newmarket saw the volatility as a feature, not a bug.

The first deal (dated Nov 22, 2024) shocked the industry.

🟧 A 63-unit multifamily property in Philadelphia.

🟧 20 Bitcoin are incorporated into the collateral package.

🟧 The loan has a 10-year term.

The buyer? Traditional home buyers who’d never considered Bitcoin before.

The lender? A forward-thinking firm that embraced blockchain.

Why does this matter?

Because it’s not just about Bitcoin OR real estate.

It’s about:

🌎 Unlocking global capital.

💸 Reducing friction in trillion-dollar markets.

⛓️ Showing how on-chain assets can revolutionize traditional finance.

But it wasn’t smooth sailing.

Regulators were skeptical.

Banks felt threatened.

Even some crypto enthusiasts said, “Why tie Bitcoin to something so legacy like real estate?”

Newmarket pressed forward.

The breakthrough moment came when Newmarket partnered with property developers.

This gave them:

🏗️ Access to prime real estate.

🧑💻 A secure pipeline for Bitcoin-backed loans.

It wasn’t just a theory anymore. It was a working model.

The numbers speak for themselves:

Newmarket Stats:

💼 Assets under Management: $2.5B.

🏢 30+ commercial properties financed.

🌐 International adoption from Asia to Europe.

Newmarket proved Bitcoin-backed loans weren’t a gimmick—they were the future.

Here’s the irony:

Real estate, long seen as a safe, boring investment, now coexists with Bitcoin—the world’s most volatile asset.

And it works. Better than anyone expected.

What’s the bigger strategy?

Newmarket isn’t just financing real estate. They’re building a bridge:

🌉 A bridge between decentralized and traditional finance.

🌉 A bridge for capital to flow freely.

🌉 A bridge to reimagine ownership.

The implications are massive.

If Bitcoin can transform real estate:

💡 What’s next? Stocks? Bonds? Entire economies?

💻 Blockchain could become the backbone of ALL asset-backed financing.

This is just the beginning.

What does this mean for YOU?

🚀 If you’re in real estate, rethink how deals are financed.

🚀 If you’re in crypto, explore how your assets can work harder.

🚀 If you’re watching from the sidelines, remember: innovation happens where old meets new.

Newmarket Capital isn’t just a disruptor. They’re proof that decentralized finance can unlock real-world value.

And their success is rewriting the rules of both Bitcoin and real estate.

What do you think? Can Bitcoin-backed loans scale globally? Or is this just a niche experiment?

Thanks for reading! Share your thoughts below.

And if this sparked your interest, hit ❤️, restack 🔁, and follow for more stories on innovation, finance, and the future.

I work with founders and executives to decentralize traditional business models by incorporating Bitcoin’s core principles. Together, we’re building BitcoinFi—the permissionless future has arrived!

Love what you read? Subscribe and never miss an update!