System Failure: Why Billionaires Keep Winning and Workers Keep Losing

#Wealth #Inflation #MoneyPrinter

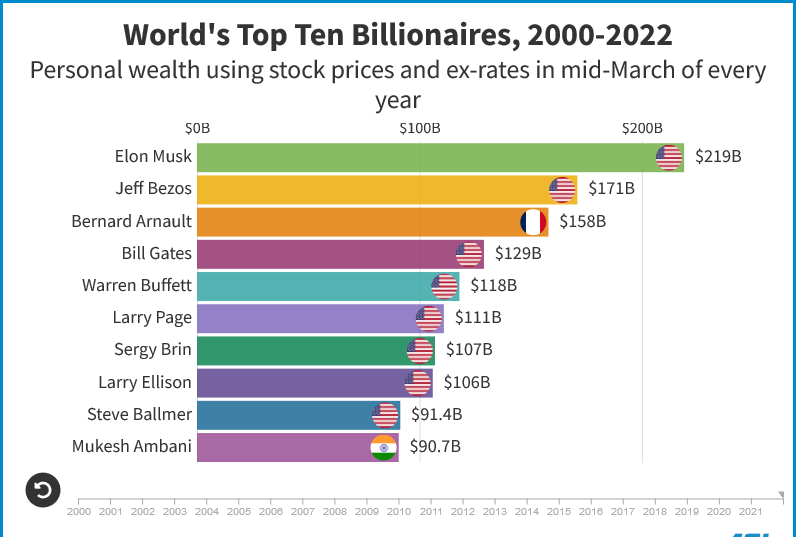

Musk: $2B to $447B. Bezos: $18B to $249B. Minimum wage: Stuck at $7.25.

This isn’t just inequality—it’s a feature of the system. A broken system.

Here’s how government spending fuels billionaires wealth while leaving workers behind.

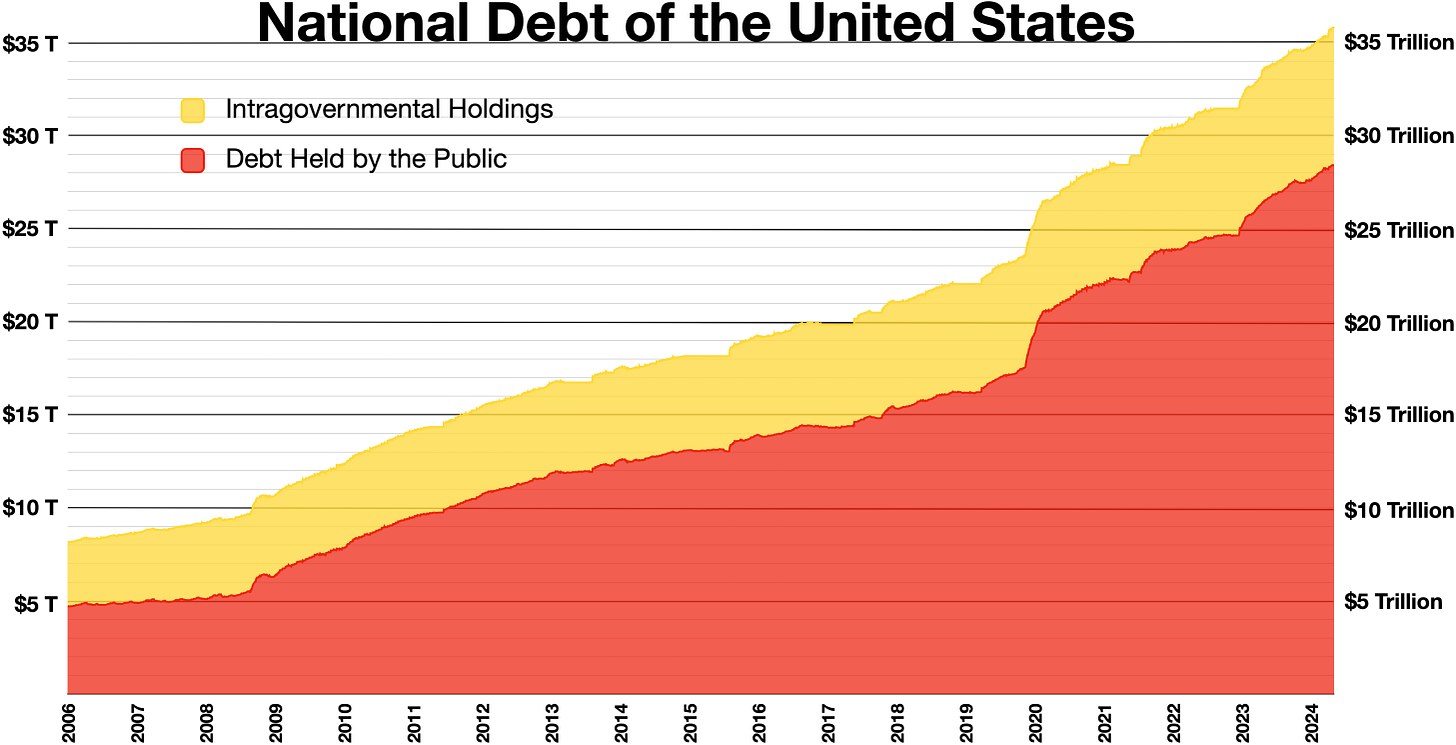

Every time DC spends above its means, the wealth gap grows.

Why? Because deficit spending is inflationary.

When governments flood the system with dollars, prices rise—but not equally. Here’s what they don’t tell you. 👇

Inflation hits assets first.

Stocks, real estate, and collectibles skyrocket when money floods the system.

Who owns these assets? Musk. Bezos. Zuckerberg.

Meanwhile, wages barely budge—and ordinary people are left holding the bag.

Let’s break it down:

Musk’s wealth in 2012: $2B

Musk’s wealth in 2024: $447B

Bezos’s wealth in 2012: $18B

Bezos’s wealth in 2024: $249B

Minimum wage in 2012: $7.25

Minimum wage in 2024: $7.25

See the problem?

But wait—it gets worse.

Every new dollar printed reduces the value of the dollars you already have.

Savings shrink. Purchasing power drops. And wages? They don’t keep up.

Meanwhile, billionaires’ stock portfolios are pumping.

Think about this:

When the government spends recklessly, it isn’t just creating inflation. It’s transferring wealth from ordinary people to asset holders.

The rich get richer. The poor lose ground. And the middle class? It gets hollowed out.

The Federal Reserve plays its part too.

Low-interest rates make borrowing cheap, encouraging speculative investments.

Tech stocks, real estate, and crypto soar. But those without access to capital? They’re left out of the game entirely.

So what’s the solution?

Fiscal responsibility.

Reckless deficit spending needs to stop. It’s not just unsustainable—it’s unethical.

The sooner DC gets its house in order, the sooner the wealth gap can begin to close.

But let’s be real—this isn’t just about government policy.

It’s about a system designed to reward those who hold assets and punish those who don’t.

The question is: How do you play the game to avoid being left behind?

Here’s what you can do:

1️⃣ Invest in assets that benefit from inflation: Stocks, Bitcoin, real estate.

2️⃣ Focus on skills that increase your earning potential.

3️⃣ Build financial literacy—understand how money works in an inflationary system.

The game is rigged, but you can still win.

And let’s not ignore the hypocrisy:

Politicians who talk about “helping the middle class” often vote for policies that widen the wealth gap.

Want to really help? Stop devaluing people’s hard-earned dollars.

Meanwhile, billionaires aren’t the villains here. They’re just playing by the rules of a broken system—and winning.

The real question: Why aren’t policymakers fixing the rules? Who benefits from keeping the system as-is?

Here’s the bigger picture

The system can be changed.

Sound money policies, responsible spending, and investment in real economic growth—not asset bubbles—can close the gap.

But it starts with accountability.

Until then, remember this:

Inflation isn’t just a number on a chart. It’s a stealth tax.

And every dollar printed without accountability makes life harder for the people who can afford it the least.

Musk, Bezos, and Zuck will keep winning until we change the game.

But you don’t have to lose. Learn the system. Play it smart. Build assets.

And demand accountability from those in power.

Thanks for reading! Love what you read? Subscribe and never miss an update!